Link: Apply now for the Capital One Spark Cash Plus (Rates & Fees)

The Capital One Spark Cash Plus is one of the best business cards out there, whether you’re looking to earn cash back or travel rewards. We’ve just seen a phenomenal new welcome offer rolled out on the card, and it could very well be worth taking advantage of.

In this post:

Huge limited time Capital One Spark Cash Plus bonus

The Capital One Spark Cash Plus is offering a limited time two-part welcome bonus, of up to $3,000 cash back:

- Earn $1,500 cash back after spending $20,000 within the first three months

- Earn an additional $1,500 cash back after spending $100,000 within the first six months

This new bonus is massive. For reference, the previous welcome offer was for $1,200 cash back after spending $30,000 within the first three months. So with this new offer, you earn $1,500 for spending $20,000 (rather than $1,200 for spending $30,000), and there’s even an additional spending threshold.

Admittedly this spending requirement is significant, but the reward is big as well. Since the Spark Cash Plus offers a minimum of 2% cash back, this means:

- You’d earn a minimum of $1,900 total cash back after spending $20,000 within the first three months; that’s like earning 9.5% cash back on the first $20,000 spent

- You’d earn a minimum of $5,000 total cash back after spending $100,000 within the first six months; that’s like earning 5% cash back on the first $100,000 spent, or put differently, earning 3.875% cash back on the $80,000 in incremental spending above the initial threshold

As I’ll cover below, you can potentially get even more value by converting these rewards into Capital One miles.

How rewarding is the Capital One Spark Cash Plus?

For those not familiar with the $150 annual fee Capital One Spark Cash Plus (Rates & Fees), this is one of the most rewarding business cards out there, and one of the all-around best cash back cards:

- The card offers unlimited 2% cash back, making it one of the best cards for everyday spending

- The card offers an additional $150 cash back when you spend $150,000 on the card in a year, so it’s especially rewarding for big spenders; think of the card as offering a refund of the annual fee for big spenders

- The card is a charge card, so has no pre-set spending limit, making it ideal for big purchases

- The card has no foreign transaction fees, so you can earn 2% cash back globally

Read a full review of the Capital One Spark Cash Plus.

Convert cash back into Capital One miles

One awesome thing about the Capital One Spark Cash Plus is that you can convert cash back into Capital One miles at the rate of one cent per mile. That means the bonus of $3,000 could also get you 300,000 Capital One miles.

If you have the Capital One Spark Cash Plus in addition to a card like the Capital One Venture X Rewards Credit Card (review) (Rates & Fees), Capital One Venture Rewards Credit Card (review) (Rates & Fees), or Capital One Spark Miles for Business (review) (Rates & Fees), then each cent can be converted into one Capital One mile.

Personally I value Capital One miles at 1.7 cents each, meaning that the $3,000 bonus is potentially worth $5,100 (based on my valuation of 500,000 Capital One miles). If you’re able to pull off the spending requirement, this is an excellent return for such a large amount of spending.

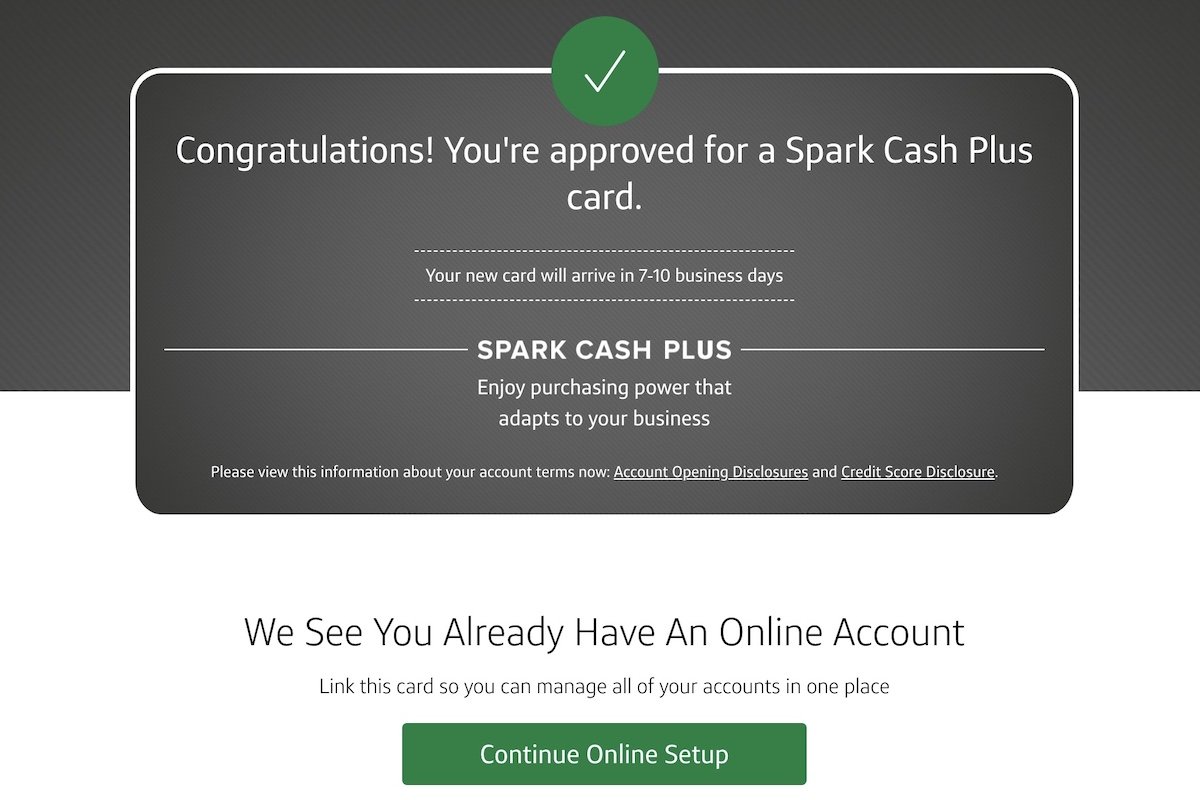

Can you get approved for the Capital One Spark Plus?

All card issuers have some general application restrictions. However, Capital One probably has among the fewest consistent restrictions. Specific to the Capital One Spark Cash Plus, the welcome offer on the card isn’t available to those who already have the card, or those who who currently have the Capital One Venture X Business (review) (Rates & Fees).

Read my guide to getting approved for the Spark Cash Plus.

Bottom line

The Capital One Spark Cash Plus has an exceptional new limited time welcome bonus of up to $3,000 cash back. This bonus can be earned in two parts, including $1,500 cash back after spending $20,000 within three months, plus an additional $1,500 cash back after spending $100,000 within six months. That bonus cash back could even be converted into Capital One miles.

If you are in a position to complete the spending requirement, this is a phenomenal bonus on a great card. The only other consideration is that there’s also merit to picking up the Capital One Venture X Business, which also has an exceptional bonus, so that could be worth considering if you’re looking to use the card for travel.

Do you plan on picking up the Capital One Spark Cash Plus with a $3,000 bonus?

If my math is correct, this is a better offer than the Venture X Business card. With Venture X Business, you receive 150,000 miles/points after spending $30,000 on the card in 1st three months. With the Spark Plus Business card, you receive the same amount for only spending $20,000.

Am I overlooking something?