Link: Apply now for the Chase Sapphire Reserve® Card

The Chase Sapphire Reserve® Card (review) is one of the most popular premium travel rewards cards. The card offers all kinds of valuable benefits, and for many of us the perks more than offset the $550 annual fee. Among other things, the card offers 3x points on dining and travel, a $300 annual travel credit, a Priority Pass membership, a Global Entry or TSA PreCheck fee credit, and more.

While the benefits for the primary cardmember of the Chase Sapphire Reserve might be straightforward, there’s often some confusion about what benefits authorized users on the card receive. I wanted to cover that in this post in a bit more detail.

In this post:

How much does it cost to add a Chase Sapphire Reserve authorized user?

You can add authorized users to the Chase Sapphire Reserve for an annual fee of $75 per person per year. In other words, you’d pay $75 to add one authorized user, $300 to add four authorized users, etc. This is in addition to the annual fee for the primary cardmember.

How do you add a Chase Sapphire Reserve authorized user?

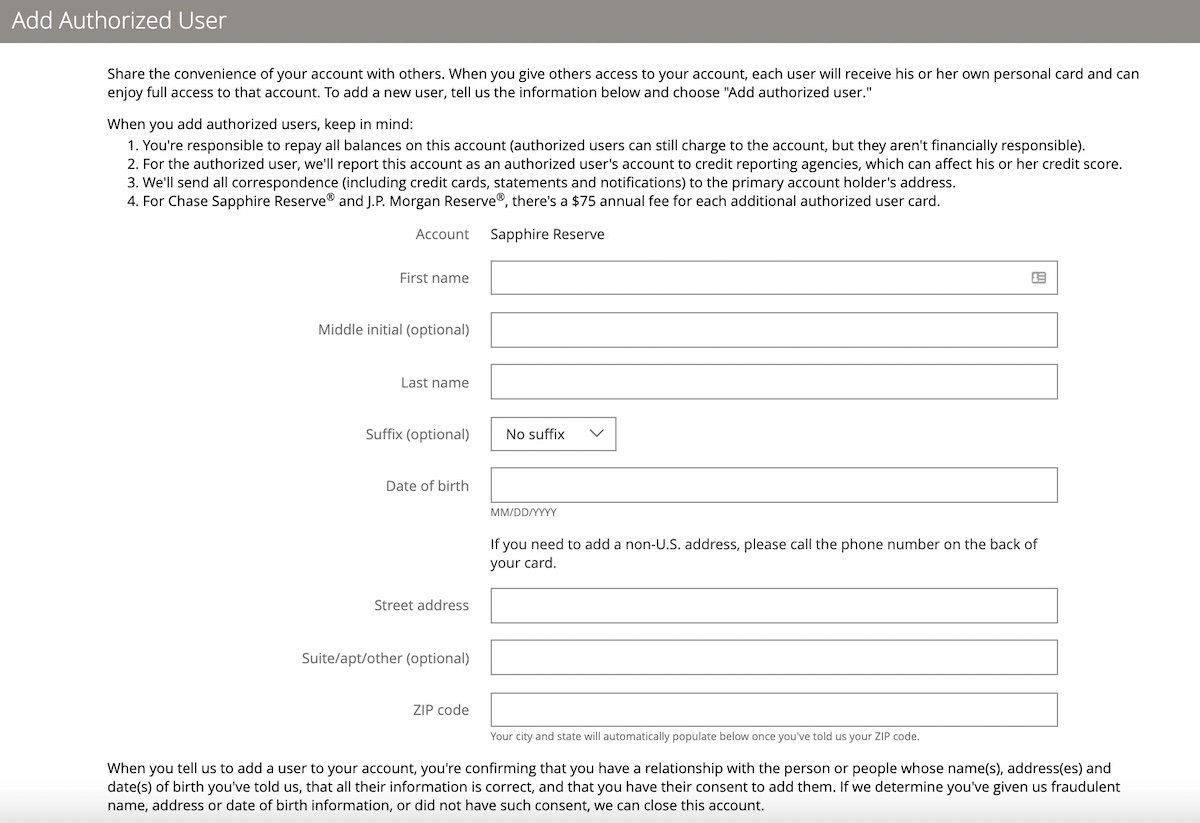

Adding an authorized user to the Chase Sapphire Reserve is easy. Just log into your Chase account, and then click on your Sapphire Reserve. Then go to the “Account services” section, and click on “Add an authorized user.”

There you’ll just have to enter the name, date of birth, and address of the person you want to add to your card. Once requested, the card will be mailed to the primary cardmember, and it will be up to them to get the card to the authorized user.

I should also mention that if you’re an authorized user on the Chase Sapphire Reserve you’d still be eligible to apply for the card yourself, including earning the bonus. Furthermore, there’s no credit pull (hard or soft) for the authorized user.

What benefits do Chase Sapphire Reserve authorized users get?

Which Chase Sapphire Reserve benefits do authorized users receive?

- The Chase Sapphire Reserve has awesome bonus categories, and the spending of authorized users racks up points at the higher rate, including earning 3x points on dining and travel; that being said, the points are accrued by the primary cardmember, who is also responsible for paying the bill

- Chase Sapphire Reserve authorized users get a Priority Pass membership, allowing them to access 1,300+ lounges around the world with two guests, including Priority Pass restaurants; this is the same Priority Pass benefit offered to the primary cardmember

- Chase Sapphire Reserve authorized users get the same rental car coverage and travel protection that the primary cardmember receives, when using their card for eligible purchases

- Chase Sapphire Reserve authorized users receive Visa Infinite perks, which include Visa Infinite Concierge Service, access to the Visa Infinite Luxury Collection, and more

I’d say one of the primary reasons to add an authorized user is for the Priority Pass membership with guesting privileges. Getting that for just $75 per year is a phenomenal value for anyone who flies with any frequency.

What benefits don’t Chase Sapphire Reserve authorized users get?

In the interest of being thorough, unlike the Chase Sapphire Reserve primary cardmember, authorized users don’t receive:

- A $300 annual travel credit; charges made by the authorized users can qualify toward this, but there’s no additional credit for authorized users

- An additional Global Entry, TSA PreCheck, or NEXUS credit; charges toward this by authorized users can qualify toward this perk, but there’s no additional credit for authorized users

How does this compare to the Chase Sapphire Preferred authorized user benefits?

The Chase Sapphire Preferred® Card (review) has an annual fee of just $95 for the primary cardmember, and there’s no cost to add authorized users. Since many people try to decide between the Sapphire Preferred and Sapphire Reserve, this is something worth considering.

Being able to add authorized users on the Chase Sapphire Preferred at no extra cost is potentially a valuable advantage. The way I view it:

- If the people you’re adding as authorized users greatly value a Priority Pass membership, then having a Sapphire Reserve and adding them as authorized users is your best bet, because paying just $75 for such a membership is a good deal

- If the people you’re adding as authorized users are using the card primarily for spending (the Chase Sapphire Preferred has awesome bonus categories as well), and if they value great rental car and travel protection, then the Sapphire Preferred does the trick

How does this compare to other premium card authorized user benefits?

Adding authorized users to the Chase Sapphire Reserve can represent a good value, though how does it compare to the two other most popular premium cards?

- The Capital One Venture X Rewards Credit Card (review) (Rates & Fees) is the best premium card for authorized users, as you can add up to four authorized users at no extra cost, and they get the same lounge access perks as the primary cardmember; if you ask me, this is the single best premium card for families

- The Platinum Card® from American Express (review) charges $195 for each authorized user (Rates & Fees), and they get the same lounge access perks as the primary cardmember, and also each get a credit for Global Entry or TSA PreCheck

If you ask me, the Capital One Venture X is the best card for authorized users, followed by the Chase Sapphire Reserve, followed by the Amex Platinum.

Bottom line

The Chase Sapphire Reserve is a well-rounded premium travel rewards card that currently has an exceptional bonus. Cardmembers can add authorized users to the card for $75 each, and that comes with perks like a Priority Pass membership, as well as the same points earning, travel protection, and rental car coverage, as the primary cardmember gets. Mainly I just think that paying $75 per year for a Priority Pass membership with guesting privileges could be a good deal.

However, for many the Chase Sapphire Preferred may be a better fit — there’s no cost to add authorized users, and they rack up points at an accelerated rate, and also get useful travel and car rental coverage.

What do you make of the value proposition of adding Chase Sapphire Reserve authorized users?

The following links will direct you to the rates and fees for mentioned American Express Cards. These include: The Platinum Card® from American Express (Rates & Fees).

Here's a benefit I don't see anyone talk about (or I can't seem to find an answer to).

Does a CSR-AU card grant the holder access to Chase's transfer partners? In other words. CSR-AU holder also has a CFF, and has accrued UR points through their CFF card, but because they don't personally hold a CSR or CSP, they can't transfer those points out to Chase's travel partners. However, if they are a CSR-AU, does...

Here's a benefit I don't see anyone talk about (or I can't seem to find an answer to).

Does a CSR-AU card grant the holder access to Chase's transfer partners? In other words. CSR-AU holder also has a CFF, and has accrued UR points through their CFF card, but because they don't personally hold a CSR or CSP, they can't transfer those points out to Chase's travel partners. However, if they are a CSR-AU, does that now give them access to transferring their UR points earned with their CFF?

Will adding an authorized user help him/her build/improve their credit score?

A conversation with a friend made me wonder - are there any cards whose authorized users can get points credited to their OWN accounts, and not mine, the primary cardholder's? I have a friend who is eligible as an authorized user, and I would assume that responsibility, but they'd want points to be their own. This could be either a transferable points program or an airline program.

Thanks for any pointers.

With Amex Platinum/Gold/Green, all points earned are pooled in the primary account, but you can transfer those points to an authorized user's frequent flier program after they've held their card for 90 days.

Thank you!

Amex Platinium reimburses Global Entry fees for all authorized users. IMO, this puts it above CSR for authorized user benefits, especially if you add the 3 authorized users.

But if you consider how many cards you have that offers GE credits then it would completely negate the benefit of those credits.

People with multiple premium cards would have few credits, probably at least 2-3 each.

It's easy to compare each card alone. But once you fill your wallet with multiple cards, your comparison gets more complex.

But for a family with kids, you needs lots of GE credits. Just this week I had my 16 month older interviewed for GE for free thanks to Platinum AUs. Since 3 AUs cost the same as 1 AUs, this is the most bang for the buck in terms of premium card AUs only if you use all 3.

You should get more cards Antonio.

I've stop counting my GE credits at 10. Too many to care. You don't even have to spend $175 to get it. Now that's the most bang for the buck.